Philanthropy at Tate’s

With God’s assistance and direction, we have been able to help so many deserving young children and families find their love of learning at Tate’s; a joy that lasts a lifetime. Now we need your help to do even more. Nurturing, challenging, and inspiring students requires inspirational teachers, superior facilities, and exceptional program resources. We are committed to offering students the very best academic education imaginable in a peaceful, rustic environment unlike anything else you will find.

The Tate’s School of Discovery Foundation is a 501(c)3 non-profit organization dedicated to enhancing the student experience at Tate’s School by providing student scholarships, teacher support, and program resources.

DID YOU KNOW?

We maintain a 100% volunteer staff so your dollars can be as impactful as possible.

Our hope is that everyone who is a part of the greater Tate’s Community – current families, alumni families, grandparents, faculty, friends, family foundations, and corporate partners – will consider a gift to the Foundation. Our shared commitment will impact a lifetime of students. We have much to do – together!

Join us as we work to change our collective future, one child at a time!

OUR PROGRAMS

Blessing children with a rich, engaging education is supported by these Foundation initiatives:

Scholarships & Support

Student Scholarships have been awarded since the early 70’s. Families must demonstrate a need and a willingness to donate time or skills to the Tate’s community. Choosing a scholarship recipient is never an easy task because there are so many deserving students.

Dare to S.T.E.A.M.

The Dare to S.T.E.A.M. initiative brings innovative concepts in Science, Technology, Engineering, Arts, and Math into the classroom.

Resources & Teacher Support

Providing unique opportunities to enrich learning, the Resource & Teacher Support program can fill a variety of needs such as curriculum, equipment, library resources, pet therapy, and more.

WAYS TO GIVE

Make a Donation

Your gift will make a difference in the lives of all those who study, work, play, and dream at Tate’s. Each and every donation impacts our community in a positive way. We are deeply grateful for God’s guidance and the opportunity to joyfully support the superior education Tate’s School provides.

To mail your donation, please make checks payable and mail to:

Tate’s School of Discovery Foundation

9215 Bob Gray Rd.

Knoxville, TN 37923

The Tate’s School of Discovery Foundation (TSDF) is a non-profit, tax-exempt charity as described in section 501c3 of the internal revenue Code. Contributions are 100% Tax Deductible and will help to ensure a brighter future for deserving young students. FEDERAL TAX ID NUMBER is 16-1650137.

Gifts of Assets

Stocks

Making a gift of appreciated stocks or mutual funds is a simple way to change the lives of deserving students. If you have held the stock for more than 18 months and it has increased in value, a donation could provide you with important tax advantages. You could receive an income tax deduction and avoid a capital gains tax. Giving that has depreciated in value could result in a tax disadvantage for you. Consider selling depreciated stock for a tax loss and then donate the proceeds to Tate’s Foundation.

Real Estate & Personal Property

Gifts of real estate and personal property can be a wonderful way to create a legacy on Tate’s campus. Donations of antiques, scientific equipment, vehicles, art, or property can often benefit our programs.

Matching Gifts

Corporate matching gifts are a great way for Tate’s Alumni, parents, and friends to maximize their contribution and increase the impact of their gift. Simply request a matching gift form from your company and submit the completed form to the Tate’s Foundation at the time of your gift. We will take care of the rest for you.

FUNDRAISERS & SPONSORSHIPS

Thank you for your interest in supporting the Tate’s School of Discovery Foundation. Visit this page often as we will share all our special events and fundraisers here including our annual silent auction.

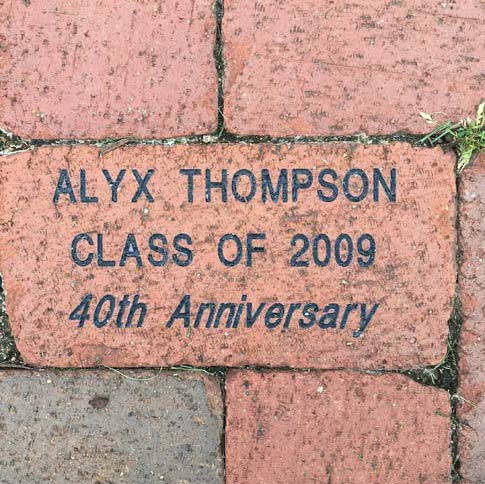

Recent Fundraisers

Tate’s Trek

50th Anniversary

Pumpkin Palooza

ADVANCED GIVING

Commit to the Lord whatever you do, and He will establish your plans. Proverbs 16:3

Bequest

A bequest is a gift made through your will or trust. Making a bequest is a generous way to leave a lasting legacy at Tate’s. You would need to meet with your advisor and add language to your will or trust that specifies that a gift be made to the Tate’s School of Discovery Foundation as a part of your estate planning.

Beneficiary Designation

This flexible charitable gift allows you to designate the Tate’s Foundation as a beneficiary. To make your gift, contact the person who manages your accounts or policies (banker, insurance agent, broker) and request a new beneficiary designation form. Complete the form, sign it, and return it to your agent. Upon your passing, your policy or account will be transferred to the Tate’s School of Discovery Foundation.

Donor Advised Fund

If you have a Donor Advised Fund through your financial institution, community foundation or non-profit organization, we will work with your fund advisor to complete the required paperwork. If you wish to remain anonymous, we will honor your request.

Endowment

Interested in making an endowed gift or named scholarship? We can help. A member of our foundation advisory team is available to meet with you to discuss the nuances of creating an endowed gift. An endowment is a group of funds set aside permanently so that only a portion of the earnings is used each year while the principle remains intact.

IRA Charitable Rollover

An IRA rollover allows people age 70½ and older to reduce their taxable income by making a gift directly from their IRA. Gifts up to a maximum $100,000 per year are eligible. You may also refer to this type of gift as a qualified charitable distribution. You get to see your gift make a difference right away and since it doesn’t count as income, it may reduce your annual income level. This is helpful as it may decrease the amount of Social Security that is subject to tax or lower your Medicare premium.

Private Family Foundation Grants

The Tate’s School Foundation works hand-in-hand with each private family foundation to ensure your funds are on mission, well-stewarded, and consistent with your goals. Once we understand your vision and values, we can help find the right fit within the Foundation. We are glad to make presentations or provide campus tours to your staff, board, and family members. We take great pride in our professional and personal integrity. Together, we can continue to change the lives of children.

Trusts, Insurance & Annuities

If you are interested in supporting our mission through a Charitable Remainder Trust, A Charitable Lead Trust, a Life Insurance Policy or Annuity, we will be happy to discuss options with you on a case-by-case basis.

This website is not intended as legal or tax advice. For such advice, please consult an attorney or your tax advisor.

SHOP & SUPPORT

HAVE A QUESTION? Contact Tracey Van Hook, Executive Director at 865.693.3021 x 1130